As the digital age continues to evolve, credit score app development is on the rise. Why? They have ended the complex cycle of loan lending and benefit both lenders and borrowers.

To get a loan, lenders need a history of credit management to lend you funds, but without a history of proper management, they will not provide you with a loan.

Reflecting on a growing awareness of the importance of maintaining a healthy credit profile.

With their user-friendly interfaces and valuable insights, credit score apps are becoming essential resources for anyone looking to navigate the complexities of personal finance.

So, why are entrepreneurs investing in this niche?

Because many consumers are becoming more aware of the importance of credit scores in financial decisions, driving the need for accessible tools.

Users want to track their credit scores in real-time to make timely decisions about loans and credit applications. Mobile apps allow users to access their credit information regardless of location, making financial management more convenient.

Moreover, the credit score market size was estimated to reach US$28 billion by 2032, with a CAGR of 18.16%. This clearly shows the upcoming opportunities in the fintech market.

So, if you are planning to invest in this segment, now is the right time to invest in credit score app development. In this blog, we will explore the features and how a credit score app works, as well as the development process and the cost of building one.

What is a credit score app, and how does it work?

Before we dive into the credit scoring app development, understand credit score first.

So, a credit score is a three-digit number that rates your creditworthiness. It ranges from 300 to 850. The higher your credit score is, the more you’ll likely get approved for loans at better rates.

You can see now why many financial institutions are investing in credit score app development. These apps have simplified complex processes and eliminated the frustration of credit check processes for both lenders and borrowers.

Yes, credit score apps are the latest fintech idea.

A credit score app allows users to track their credit scores and helps them make smart financial decisions. Many apps also allow users to apply for credit cards and receive alerts when their credit history changes. Moreover, these apps analyze credit reports and provide personalized guidance on how to improve their credit scores.

So, how exactly do these credit score apps work?

Users must download and create an account on the app, verify their identity, and access their credit score and report.

The app presents the credit score report in an easy-to-understand format, often using visual aids like graphs. Credit bureaus collect data to provide users with their credit reports.

Well, it’s easy to get going with credit score apps. After all, they have broken the complex process of loan lending. Now, let’s move to the next section to discuss the benefits of credit-scoring app development.

Benefits of credit scoring app development

Today, users are more financially literate, which creates a high demand for digital credit score app development. It benefits borrowers and financial institutions at the same time.

Let’s explore the benefits of digital credit score app development :

1. Streamlined credit assessment process

Traditional credit score-checking processes are complex. The credit score app automates the evaluation of creditworthiness, reducing the time lenders need to assess applications.

2. Improved accessibility to financial services

Credit score apps enable more individuals, including those with limited access to traditional banking, to apply for credit services, creating inclusivity for everyone.

3. Real-time credit monitoring

With a credit scoring app, users can receive immediate updates about changes in their credit scores or reports, allowing for timely action. This empowers users to manage their credit scores proactively, reducing the likelihood of negative impacts.

4. Enhanced customer experience

This offers tailored recommendations and insights based on individual credit profiles, improving user satisfaction. And AI-powered chatbots provide users with 24/7 assistance and guide them to improve their credit scores.

5. Cost reduction for lenders

Credit tracking apps can automate credit assessments and monitoring, reducing the need for extensive manual processes and saving time and resources.

6. Risk mitigation

Real-time monitoring helps identify potential risks before they escalate, allowing lenders to take preventive measures. It also provides lenders with valuable analytics to assess borrower risk more accurately.

7. Personalized financial recommendations

Offers users customized advice on improving their credit scores and managing their finances effectively. Lenders can use data analytics to present relevant financial products to users based on their credit profiles.

8. Compliance with regulations

It helps lenders comply with financial regulations by ensuring transparent and fair credit assessments. In addition, it implements robust security measures to protect user data, which aligns with compliance requirements.

Why should businesses invest in credit-scoring app development?

The digital lending market has seen impeccable growth in recent years due to technological advancement and growing digital trends such as P2P platforms, BNPL apps, and more.

The wide adoption and integration of blockchain and AI will completely revolutionize the fintech segment. The global digital lending market currently has an estimated value of US$14.4 billion and is expected to reach US$80.1 billion by 2034.

North America is said to have the highest market share in the coming years. When a market grows at a fast pace, it is more likely to open many opportunities for entrepreneurs willing to invest in this segment.

As business complexities have increased, managing vast amounts of data and identifying potential threats have become more complex daily.

For eliminating those complexities, credit scoring apps are built to manage the tiring process of credit management. With more and more users turning towards online banking for their financial needs, lenders have a pool of borrowers to target.

And this is only achievable with the credit score app development. This is why investors are willing to invest in this segment. If you plan to do the same, explore the features that are essential for creating a successful credit-tracking app.

Must have features to include in the credit score app

By leveraging real-time data, advanced algorithms, and AI/ML technologies, these apps empower users to make informed financial decisions.

Here is the list of essential features for creating credit scoring app.

| Feature | Description |

| User registration and authentication | Provide users with secure login options via social media, email, and biometrics to protect user data and privacy. |

| Secure data encryption | Use encryption protocols to safeguard user data both at rest and in transit, ensuring data privacy and security. |

| Credit score dashboard | Create a visually appealing dashboard that displays the user’s current credit score, trends, and relevant metrics. |

| Credit report analysis | Provide tools to analyze credit reports, highlight areas for improvement, and understand factors affecting the score. |

| Personalize financial insights | You can also provide customized recommendations based on use data to help them with their credit scores and financial health. |

| Credit monitoring alerts | With real-time notifications about changes in the user’s credit report or score help in detecting fraud and errors quickly. |

| Loan and credit card recommendations | Suggest suitable loan and credit card options based on the user’s credit profile and financial needs. |

| Bill payment reminders | Automated reminders for upcoming bills to help users avoid late payments and maintain a good credit score. |

| Budgeting tools | Features that assist users in creating and managing budgets to track spending and saving effectively. |

| Credit score simulation | A tool that allows users to simulate how various financial decisions will impact their credit score over time. |

| Integration with financial institutions | Capability to connect with banks and financial institutions for real-time data access and management. |

| Multi-language support | Support for multiple languages to cater to a diverse user base, enhancing accessibility and user experience. |

Advanced features to elevate the credit score app experience

When you integrate advanced features in your credit tracking mobile application, it will enhance user experience, provide deeper insights into financial health, and promote proactive credit management. Here is the following list of advanced features:

| AI-powered credit improvement suggestion | Utilize AI to analyze user data and provide users with tailored recommendations for improving credit scores. |

| Predictive credit score analytics | With machine learning algorithms use historical data to forecast future credit scores based on user behavior and financial decisions. |

| Blockchain-based data security | To enhance data security, implement blockchain technology. |

| Gamifies credit improvement tasks | With gamified elements, you can encourage users to complete tasks that improve their credit scores. |

| Customizable credit goals | Enable users to set and track personalized credit improvement goals, helping them stay focused and motivated. |

| Real-time spending analysis | Provide real-time insights into spending habits, helping users make informed financial decisions and manage their budgets effectively. |

| Subscription management tools | With these tools, users can easily track and manage their subscriptions, ensuring they don’t miss payments and maintaining good credit. |

| Financial advisor integration | This feature lets users connect with certified financial advisors for personalized advice and strategies to improve their credit and overall financial health. |

| Voice-activated assistance | With voice recognition technology, you can allow users to interact with the app with voice commands for ease of use. |

Step-by-step process of credit scoring app development

The digital credit scoring app development process involves several steps, from market research to launch. It requires proper strategy and a team of experienced mobile app developers who understand your idea and work accordingly.

Here are the following steps for building a credit score app:

1. Market research

The process of creating a successful credit-scoring app begins with market research. Extensive market research will help you find out the core value of your app and identify market gaps. Most importantly, it will help you understand that your app is providing better services than the other competitors.

You leverage market research methods such as surveys, social media listening, and data collection. Also, conduct competitor analysis and SWOT analysis, and you will easily pass every hurdle in the credit score app development process.

2. Decide on features

Now, decide on core features like the credit score checker, which allows users to view their credit scores. You can also implement tools to monitor changes over time and provide tips based on user data to improve credit scores.

Moreover, additional features, such as alerts for changes in credit scores and integration with financial institutions for real-time data, should be considered.

3. Choose the tech stack

You need a robust and advanced tech stack to start the development process. For the front end, Android app developers leverage React Native and Flutter, while Swift and Kotlin are used for iOS. Backend technologies like Node.js, Python, and Ruby on Rails are used, and many other technologies are involved in the process, which we will discover in the next section.

4. Design UI/UX

Now, it’s time to start the designing phase. Creating a user-friendly app is crucial, so you might start with simple sketches to plan how the app will look and work.

The team of UI/UX designers will create a user-friendly interface with intuitive navigation. They often start by creating wireframes and prototypes to visualize the app’s flow.

5. Credit score mobile app development

With app design in place, begin your credit score mobile app development, where you build the app step by step. You need to follow the agile methodologies to create a successful fintech app.

The agile approach allows you to make changes based on feedback. Integrating APIs is also essential for connecting to credit bureaus, enabling score retrieval and tracking.

6. Testing

After completing the development process, the app needs to be tested. The QA team will perform various tests to eliminate performance and bug issues.

They will conduct various testing to identify bugs, usability issues, and security vulnerabilities. The different types of testing, such as beta testing, automated testing, and usability testing, will help you rectify any issues if they occur.

7. Launch

Once the app is ready, launching it involves optimizing the app store listing for visibility and implementing a marketing strategy to promote it through social media and partnerships.

Moreover, KPI’s user engagement, downloads, and retention rates can be monitored by using analytics tools to make data-driven decisions.

8. Maintenance and updates

Lastly, invest in maintenance and updates to keep your app successful in the long run by providing continuous maintenance, upgrades, and support to keep up with the latest industry trends.

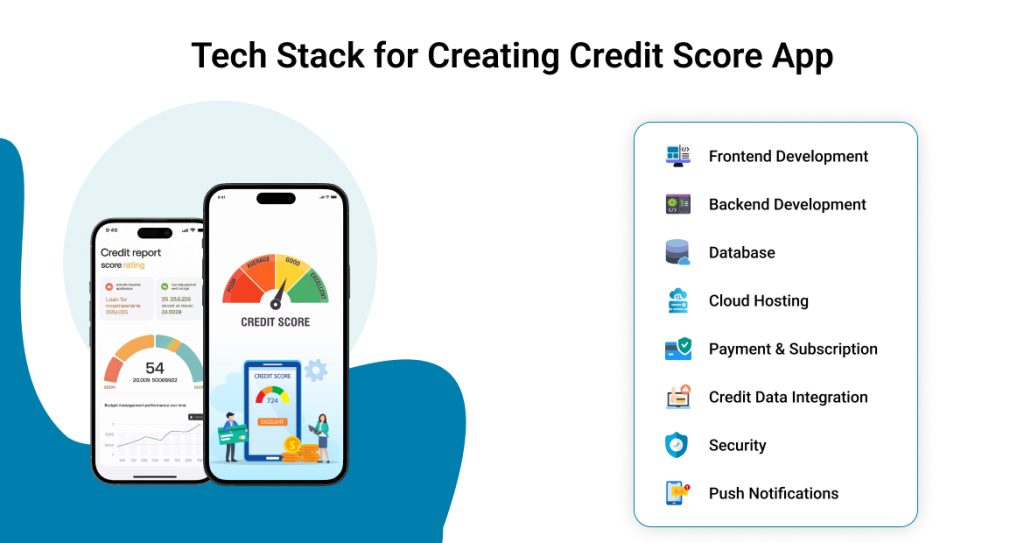

Tech stack for creating credit score app

With the right set of tools and technologies, you can create a secure credit score app that provides users with seamless navigation. We have created a list of tech stacks appropriate for creating a credit score checker app.

| Category | Technology/Tool |

| Frontend Development |

|

| Backend Development |

|

| Database |

|

| Cloud Hosting |

|

| Payment & Subscription |

|

| Credit Data Integration |

|

| Security |

|

| Analytics & Insights |

|

| Push Notifications |

|

| DevOps |

|

How much does it cost to build a credit score app?

So, how much does it cost to build a credit-scoring app? This is the common query of every investor. However, there is no accurate answer to this question.

The credit score app development cost typically ranges from $20,000 to $300,000 or more, depending on various factors. These factors include features and functionality, location of the development team, and platform choice.

The basic app with minimal functionalities such as credit score, a simple dashboard, and notifications costs you less. But if you are planning to build an app with advanced features like AI and ML integration, the cost is higher compared to a basic app.

It will cost more for additional features like credit monitoring, special tools for each user, bank connections, and a strong security system.

Additionally, lucrative design, implementation, integration with banking systems, data protection, and privacy act, as well as scrutiny and testing for security purposes, can be reasons for the budget increase.

If you plan to build an application with as many features as possible, enhanced design, and clear navigation, this will significantly affect the timeline and overall cost.

In other words, the total cost depends on the app’s complexity and your requirements. To make the most out of your application while spending the least, it is important to begin the project by laying down the right blueprint and then collaborating with an excellent development team.

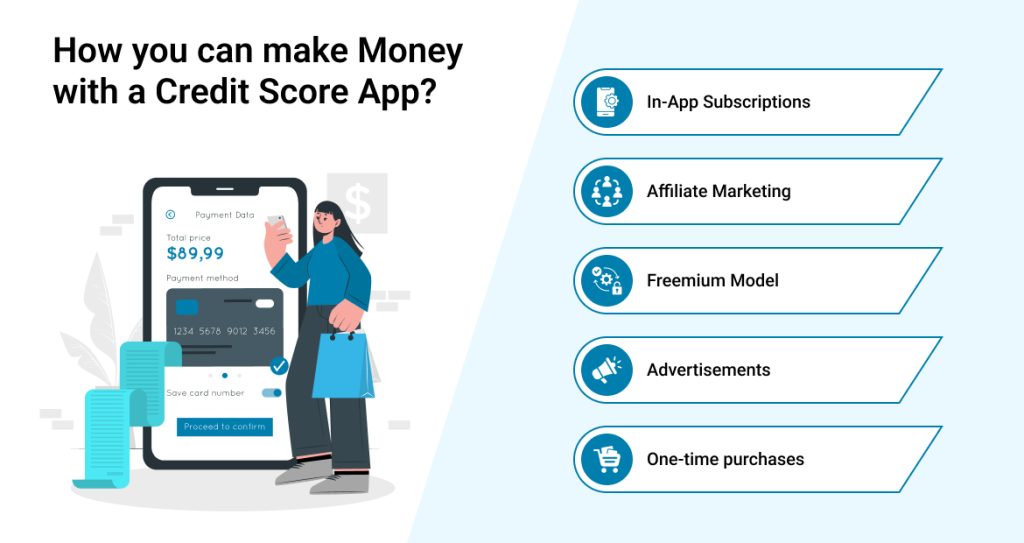

How you can make money with a credit score app?

Making money with a credit score app is all about tapping into the financial services ecosystem and offering value to users. Here are some practical ways you can generate revenue:

1. In-App Subscriptions

Offer premium features like detailed credit reports, personalized financial advice, or real-time credit monitoring as part of a subscription plan. Many users are willing to pay a monthly or annual fee for these added benefits.

2. Affiliate Marketing

Partner with financial institutions to recommend their credit cards, loans, or other financial products. You earn a commission every time a user signs up through your app.

3. Freemium Model

Provide basic features for free but charge for advanced tools like credit utilization analysis, budgeting tools, or educational courses. This approach attracts a broad user base while converting some into paying customers.

4. Advertisements

Display targeted ads from banks, credit card companies, or financial planners within your app. With a well-designed layout, you can generate ad revenue without disrupting the user experience.

5. One-time purchases

Offer pay-per-use features like detailed credit reports or credit health check-ups for users who prefer not to subscribe.

How can we help?

Since millions of users access their credit scores daily, you must create the best credit score application to meet growing consumer interest in financial literacy and products. Emizentech is one of the leading mobile app development company ready to help you creating the one.

We, therefore, offer mobile app solutions that are not only good to use but also secure for users. We will help you create lucrative, user-friendly screens and incorporate basic functionalities such as live credit reporting, customized financial tips, and bank connections.

Security is the top most priority at Emizentech, and this is through the use of encryption plus adherence to data laws such as GDPR to safeguard your users’ data.

If you have a unique idea and plan to develop a platform with integrated tools, such as loan calculators and credit utilization tracking features, our team can make it happen.

When choosing to work with Emizentech, it is important to know that we will be getting a system built not only for now but also for the future of FinTech. Let us assist you in making an application that shall aid its users and help you establish in the market at the same time.

Key Takeaways

- Credit score app development is creating a buzz in the market, and it helps users monitor their credit scores and understand their financial health.

- Certain technologies, such as Swift, Java, MongoDB, and others, are used to create credit score apps.

- You can leverage the advanced tech stack to enhance the user experience of your credit scoring app.

- Features like score tracking, credit monitoring alerts, and automated support will help you create a unique app.

- Partnering with an experienced fintech app development company, like EmizenTech, will help you create a high-quality business-centric app.

FAQs

How long does it take to build a credit score app?

Building a credit score app typically takes around six months to a year, depending on the complexity of your app.

What is the difference between credit score and CIBIL score app development?

CIBIL score app development is the process of creating an app that allows users to check their CIBIL score specifically. On the other hand, the credit score app caters to a global audience where users can check their CIBIL and leverage comprehensive monitoring tools.

Is the credit score app legit?

Yes, many credit score apps are legitimate and provide valuable services. They allow users to check their credit scores for free or at low cost. However, it is essential to choose reputable apps that financial institutions or companies back to ensure accuracy.

How do credit scoring apps work?

Most reputable credit score apps prioritize user security and employ encryption and other security measures to protect personal information. Before using any app, read its privacy policy and terms of service to understand how your data will be used.

Is the credit app secure?

Credit scoring apps work by accessing your credit report from credit bureaus and collecting data on your credit history, including payment history, credit utilization, and account type. The app then calculates your credit score based on this information and presents it to you.